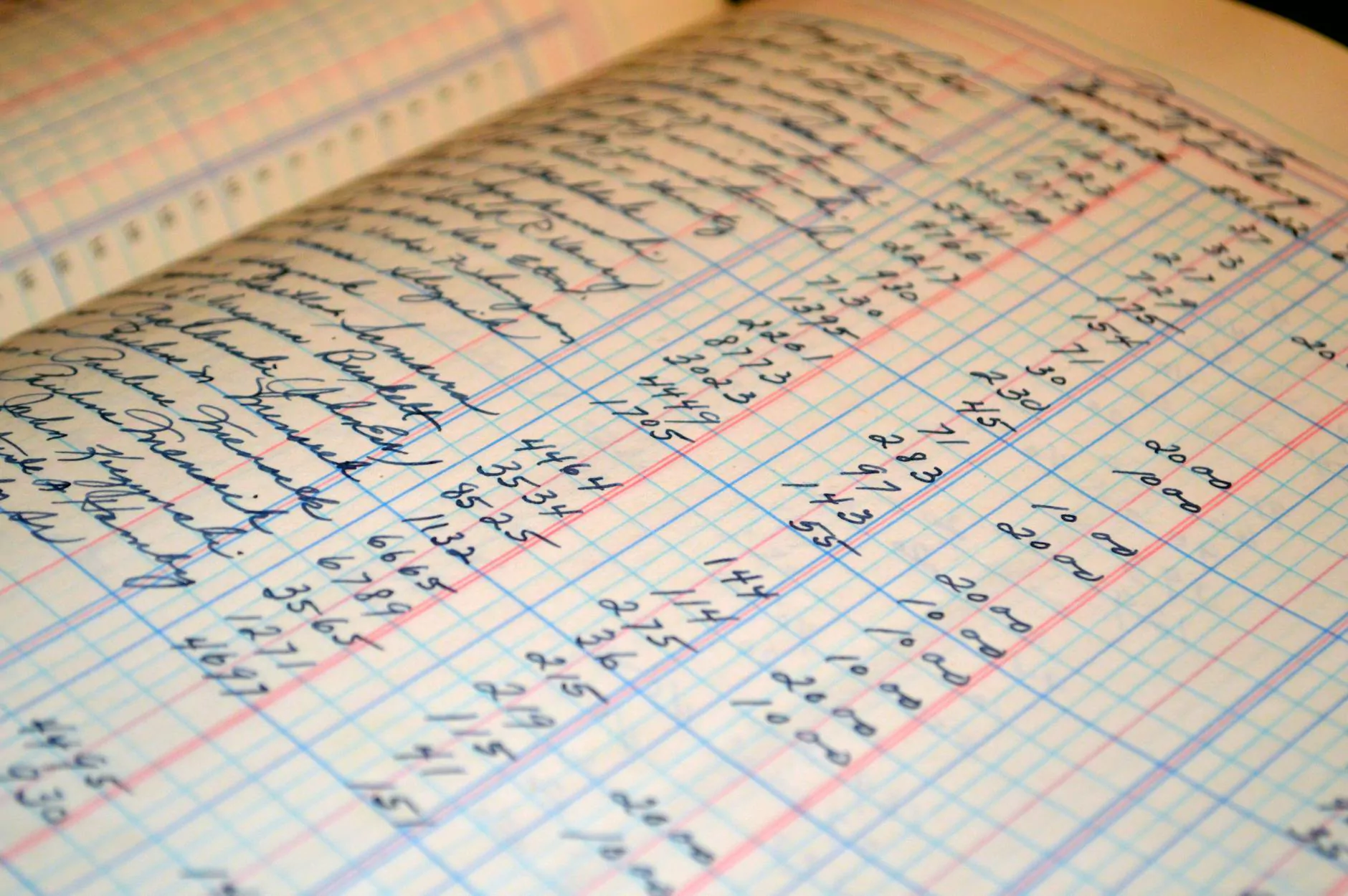

The Impact of Bookkeeping and Accounting Services on Business Success

When it comes to running a successful business, proper bookkeeping and accounting play a crucial role in ensuring financial stability and growth. Businesses that invest in effective financial services, financial advising, and accountants are able to make informed decisions, manage cash flow efficiently, and stay compliant with regulations.

Financial Services for Business Growth

Financial services encompass a wide range of activities that help businesses manage their money, investments, and assets. From budgeting and forecasting to financial reporting and analysis, these services provide businesses with the tools they need to make strategic decisions for growth.

Benefits of Financial Advising

Financial advising is essential for businesses looking to navigate complex financial landscapes. Professional advisors can offer tailored solutions to optimize cash flow, minimize risks, and maximize profits. By working with financial advisors, businesses can create sound financial strategies that align with their long-term goals.

Importance of Accountants in Business Operations

Accountants are the backbone of bookkeeping and accounting processes in a business. They are responsible for maintaining accurate financial records, preparing tax returns, and ensuring compliance with financial regulations. By enlisting the services of skilled accountants, businesses can avoid costly errors and focus on driving growth.

Enhancing Efficiency with Bookkeeping and Accounting

Proper bookkeeping and accounting practices are essential for maintaining accurate financial records, tracking expenses, and monitoring financial performance. By staying organized and up-to-date with financial data, businesses can streamline operations, identify areas for improvement, and make informed decisions to drive success.

Maximizing Profitability Through Financial Analysis

Financial analysis is a key component of bookkeeping and accounting that helps businesses understand their financial health and make data-driven decisions. By analyzing financial statements, cash flow projections, and profitability ratios, businesses can identify trends, opportunities, and potential risks to optimize their financial performance.

Ensuring Compliance and Peace of Mind

Compliance with tax laws and financial regulations is essential for businesses to avoid penalties and legal issues. Professional accountants can help businesses navigate complex tax codes, stay up-to-date with regulatory changes, and ensure compliance with reporting requirements. By entrusting accounting professionals with these tasks, businesses can focus on their core operations without worrying about financial compliance.

Conclusion

In conclusion, investing in bookkeeping and accounting services is vital for businesses looking to achieve long-term success and sustainability. By leveraging financial services, financial advising, and accountants, businesses can enhance their financial management practices, make informed decisions, and drive growth. Embracing the importance of proper bookkeeping and accounting can set businesses on a path to prosperity and resilience in today's competitive market.